USER RESEARCH

Survey

7

80

49

Participant in Interview

Respondents in survey

Website visited

What is your age?

Which of the following applies to your current residence?

84.8%

63.7%

23.8%

11.3%

20-35 YEARS OLD

35-45 YEARS OLD

45-60 YEARS OLD

60+ YEARS OLD

Urban

Semi urban

Rural

Can’t say

1

2

79 responses

80 responses

What is your gender?

53.8%

45%

Male

Female

prefer not to say

3

80 responses

Who makes your financial decision?

33.3%

46.2%

20.5%

Me

Me and someone else

Someone else make the decision

4

78 responses

46.2% persons who manage finance with someone and 20.5% whose finance managed by someone else it is important to know that in almost all cases it is managed by either parents or spouses.

How has finance management assisted you in the past?

38.8%

20%

41.2%

I have fair idea about finance management &

it serve me well

I have fair idea about finance management but

did not get anyprofit or help from it

I don’t have any idea about it

5

80 responses

41.2% people don't have any idea about finance management whale 86% people said its is important for them.

While describing their fears about finances, 60% said it was online fraud, and only 17% felt it.

Secondary research

Stats

A Deloitte India report in 2018 revealed that millennials spend more than 50% of their disposable income on apparel, accessories and entertainment.

“Millennials are remarkably different in their spending habits from their parents. They are more focused on short-term goals and experiences as opposed to their parents’ affinity to long-term goals and assets. ”

“Some financial habits of millennials tend to come across as alarming to the previous generations.”

“

”

“

”

Brief

People recently are finding it difficult to manage their finances to maintain a balance between enjoying newly achieved financial freedom and achieving their materialistic dreams.

TrackP

Personal

Finance

Management

rack

T

oal

G

earn

L

Personal Finance Management

Problem Space

What would have seemed a completely alien concept a decade ago, has now grabbed the headlines worldwide. Personal Finance management and financial literacy are buzzwords now.

We wanted to make people financially independent by understanding their problems and managing their finances. We wanted to do this to shield people from financial hiccups.

Why this problem

After online payments became a regular thing, money just became a number. People generally spend too much, and they do not even feel it. It derails people’s financial plans and makes them vulnerable to hiccups.

Everyone has something to buy and plans for it. Some do it properly, meaning they buy a mutual fund or invest in RD, etc.; others take sudden decisions. People need proper guidance for navigating towards their financial goals

After the share market fall in march 2020, we have seen a tremendous rise there. Surprisingly this rise has significant retail investors who are investing through investment apps. People are doing it just for fun. Learning in this scenario has gone to the back seat.

Expense tracking

Tracking and achieving a financial goal

Finance management learning

Process

Discover

Research

Analyse

Ideate

Prototype

1

2

3

4

5

Knowns

Unknowns

People shift to new cities

Due to fomo and peer pressure they Make decision

Open to take financial risk

Spending habits includes urban lifestyle

Hard to resist expenses

They tend to spend on stuff that are not necessary

They manage their own finance

Investment apps are growing

How do educational background affect their financial habits

Does gender affects the financial habits

Salary distribution

Do they prefer any financial advice

Do they want to save

Do they know repercation of financial breakdown

Do they track their spendings

How financial habbits differ for urban and rural

Research findings of millennial behaviour

In general

From history

Current scenario

56% of millennials invest in Mutual Funds.

Wealth is the top life goal for 80% of millennials.

36% of Indian millennials have a fitness app installed on their phones.

28% of millennials eat out at least once a month.

91% of millennials believe in making their financial decisions by themselves without having to depend on someone.

Contribute 70% to the total household income.

91% of the millennials believe in making their own investment decisions. Events like the financial crisis of 2008 diminished their trust for financial planners and experts.

Over half (54%) of Millennials, according to the First Insight survey, surveyed indicated that coronavirus affected their purchase decisions—more than any other generation. This has prompted 40% of Millennials to state that they were cutting back on spending in preparation for the financial uncertainties that may result due to the coronavirus pandemic.

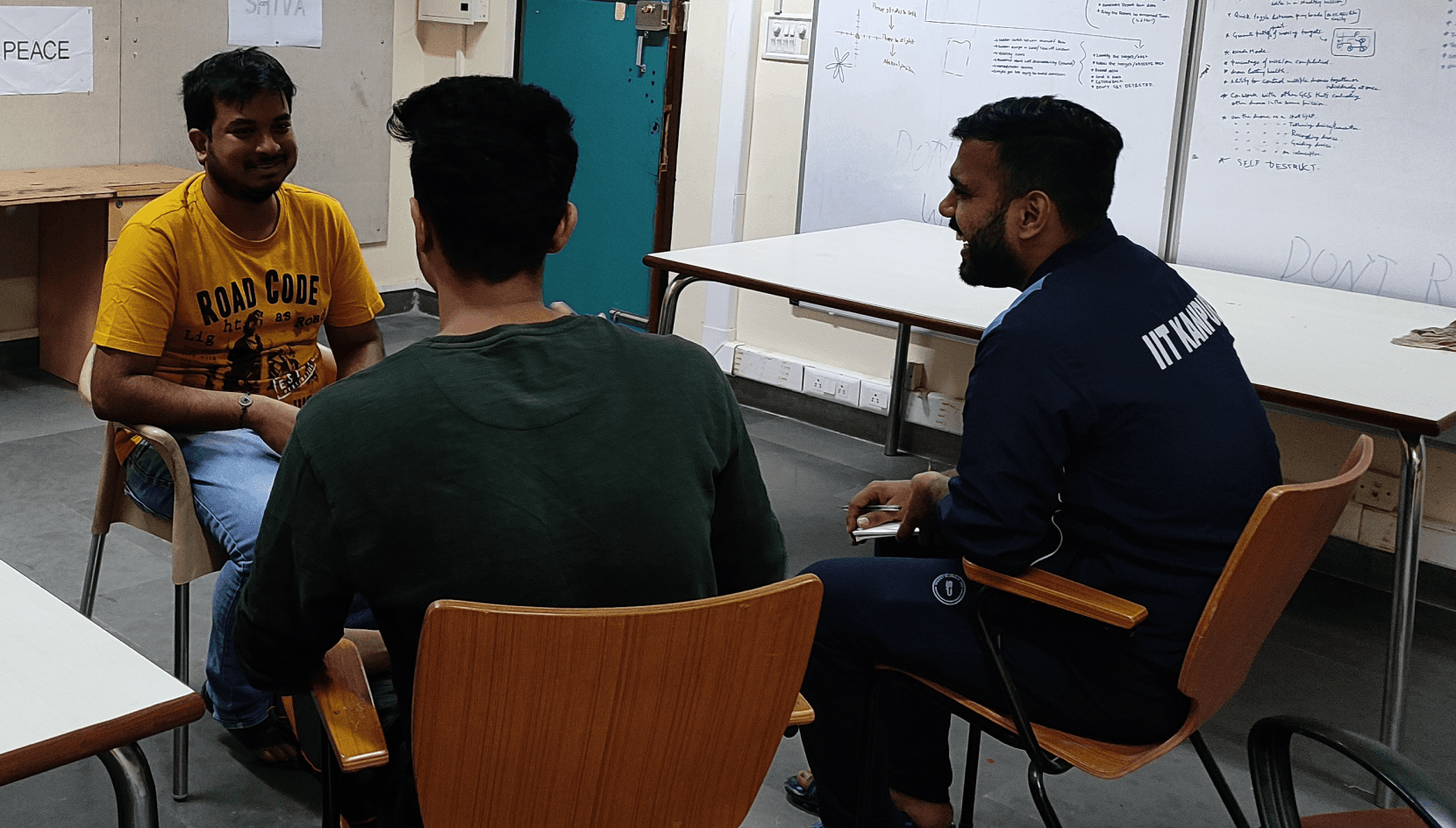

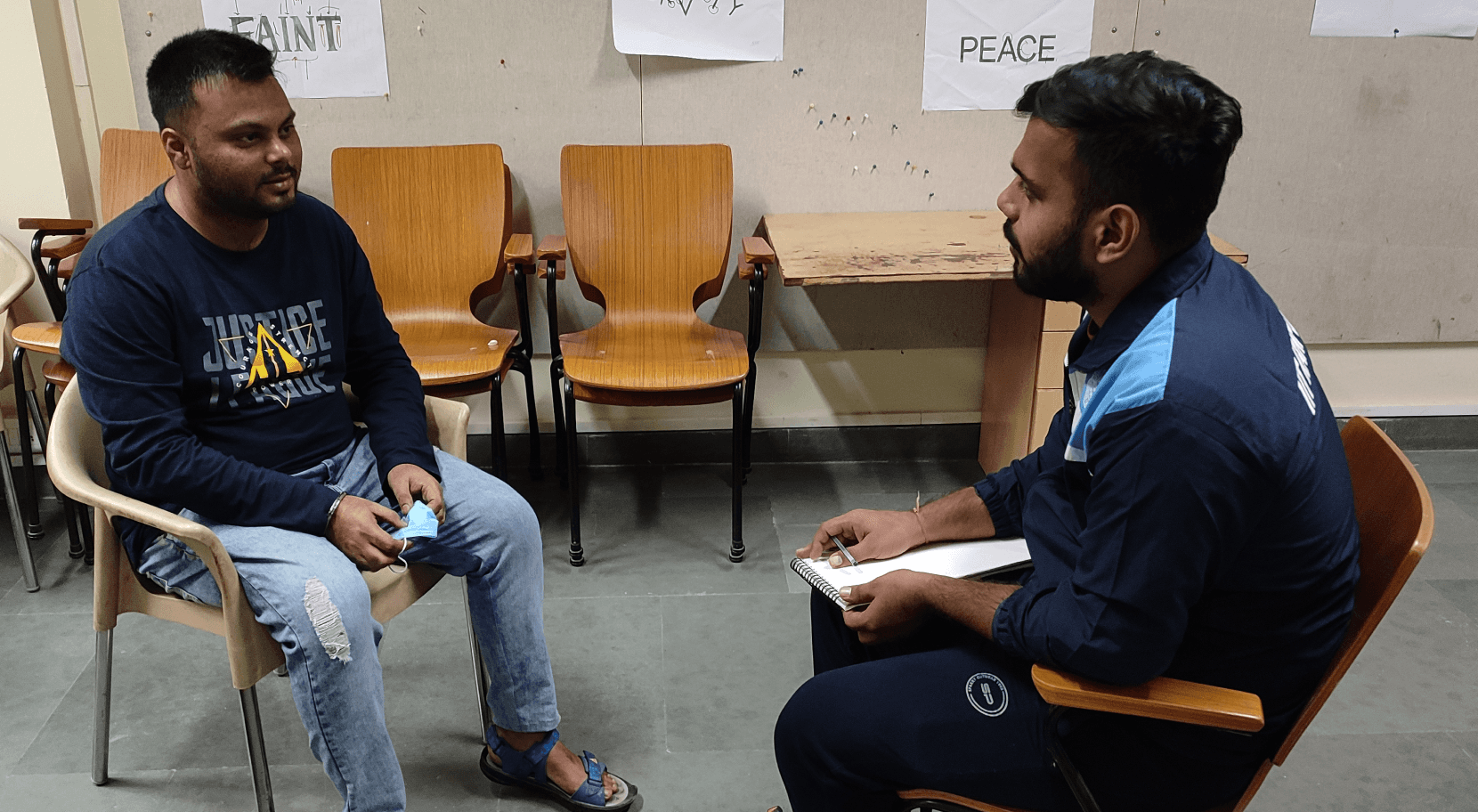

Interview

I invested in stocks because of my friend and lost all my money there. That trauma still exists; I will never invest in stocks in the future.

“

”

“

”

“I want to learn the basics of financial management to become financially free in the future, but managing and tracking take a lot of time.”

“

”

“I want to earn and invest my money so that I can spend on luxury trips and items, but unwanted expenditures sometimes derail me.”

To track small expense

To get report on expenses

To track SMSs mails, and notifications

People go to different payment apps to track

Wait for account statement

Save various paper receipt

To make user learn by doing

To able user set up multiple goals

People do planning in mind

To help people identify wrong information

To track and block notification which create confusion

User journey

Track

Payment Apps

Banking Apps

Account statements

To give timely summary and analysis of expense

To make learning fun and eventful

Help people in keeping up with goal by reminder

Easily get deviated due to sudden and unwanted expense

Go to different websites to learn

Quickly open disturbing notification

Discuss with friends

Get confused and take action in hurry due to notification

Take help of finance learning app

Check web to confirm information

To block panic creating notification

Mind

Partner

Note apps

To learn in a gamified way

To learn how to invest

To learn about trending financial topics

Apps

Websites

Books

Friends

To get help how to control

spending

Easily set and track goals

To get proper and authentic facts

Messages

Notifications

Real time analysis and also help

In what to do next.

Touch Points

Financial Goal

Learn

Nudges

Channels

Experience

User Goals

Opportunities

User personas

Savita tracks spending cautiously. She wants to maximize her savings by using different instruments. She wants to invest in stocks but only in safe ones with proper research and analysis. She has good financial knowledge.

I love to learn about investing and I manage my own finances. I sometime struggle to track my small expenses and track my plans

Bio

“

”

Goals

Pain Points

Unplanned and untracked expenses disbalances saving and financial goals

Managing debt

Not able to track and analyse expenses

Not comfortable in taking loan

Following and tracking Financial goal is difficult

Unavailability of single platform for research

To get expense report whenever they want

To save for uncertainty

Want high return with low risk

To save taxes and maximize saving

To secure future financially

To make informed investment inspired from knowledge

Tech

Payment apps

Investment Apps

Banking Apps

Social Media

E commerce app

Demography

Age- 23

Occupation- Fashion designer

Language- Hindi, English

Shamu is a cash splasher who thinks the more money spent the more desire to earn is generated.He wants to maximize investment but at the same time he dont track his spendings. He also wants to take risks for better returns.

I want to travel the whole world and buy an SUV. I sometimes get irritated and panicked by notification.

Bio

“

”

Goals

Pain Points

Quick analysis of all spendings

Want some motivation to get a financial goal

To learn how to invest

Want to know how to maximize credit score

Block unwanted nudges

Don't have idea where to invest to maximize return

No guidance on how to invest and save

Don't know importance of saving and long term investment

Sometimes fall short of money because of financial mismanagement.

Can't stop unnecessary expenses

Tech

Payment apps

Investment Apps

Banking Apps

Social Media

E commerce app

Demography

Age- 29

Occupation- Engineer

Language- Marathi, English

“I dont know how to manage my finances”

“Dont do risky investments”

Family

“Bro lets invest in stocks”

Friends

Millenials and Gen z

“We will give you best services”

Service provider

“I can give best advice to manage your finances”

Financial advisor

Investment apps

E commerce apps

RBI

“Future is unpredictable so take policy ASAP”

Insurance agents

Stakeholder map

Key Insights

Throughout our research, we discovered that users have core needs for a successful finance managment.

The first step in managing finance is tracking expenses and goals. In research, we found out users don't have clear ideas about both. Tracking and analysis takes a lot of time which lead to avoidance

Learning about how to invest in shares is sometimes very hectic because you have to go to so many websites and youtube videos. Alsp, some people don't invest just because they are losing money.

Nudges come in the form of notification, mails, messages etc which alter investment behavior and sometimes create panic. These negative nudges create insecurity which sometime lead to heavy losses.

Track

Learn

Nudges

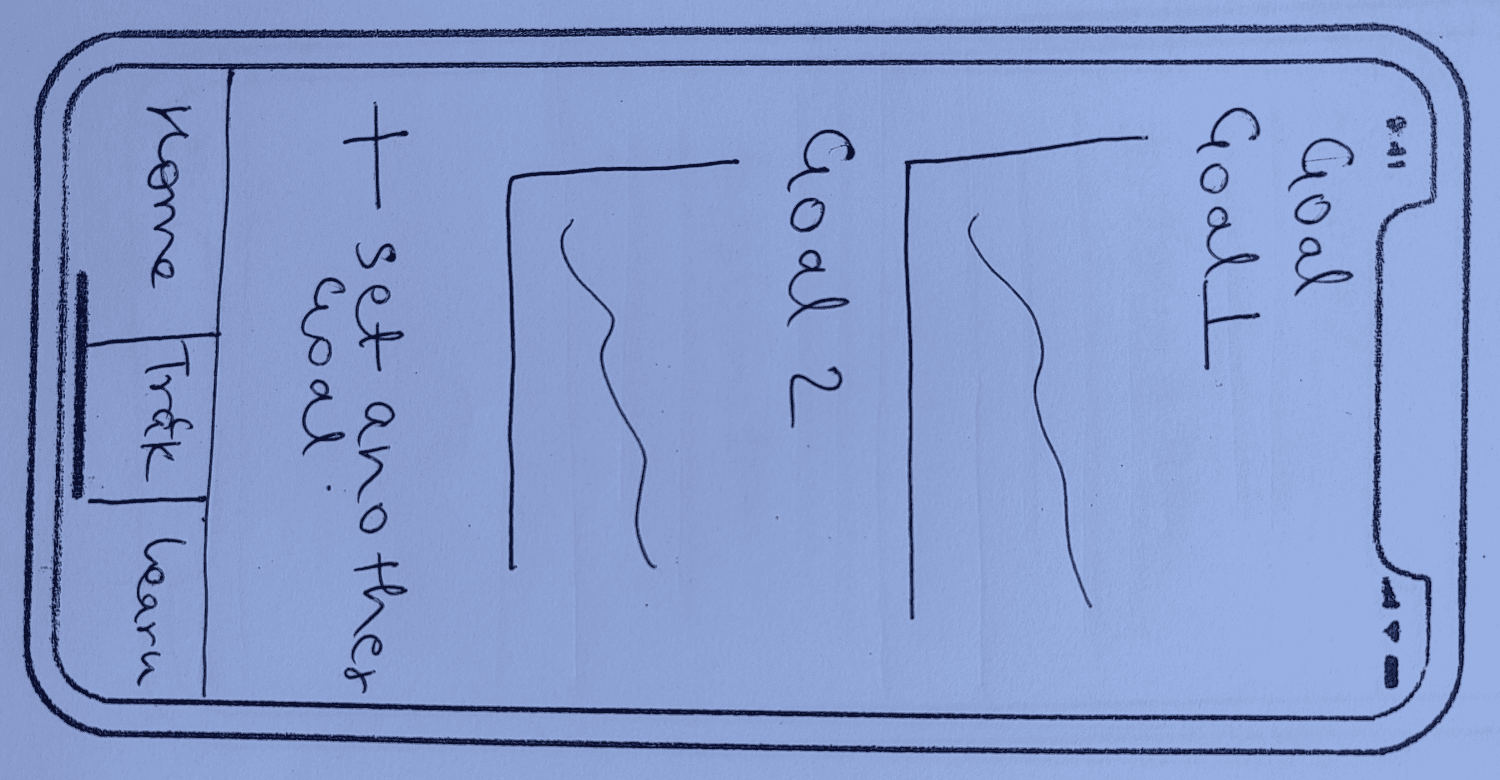

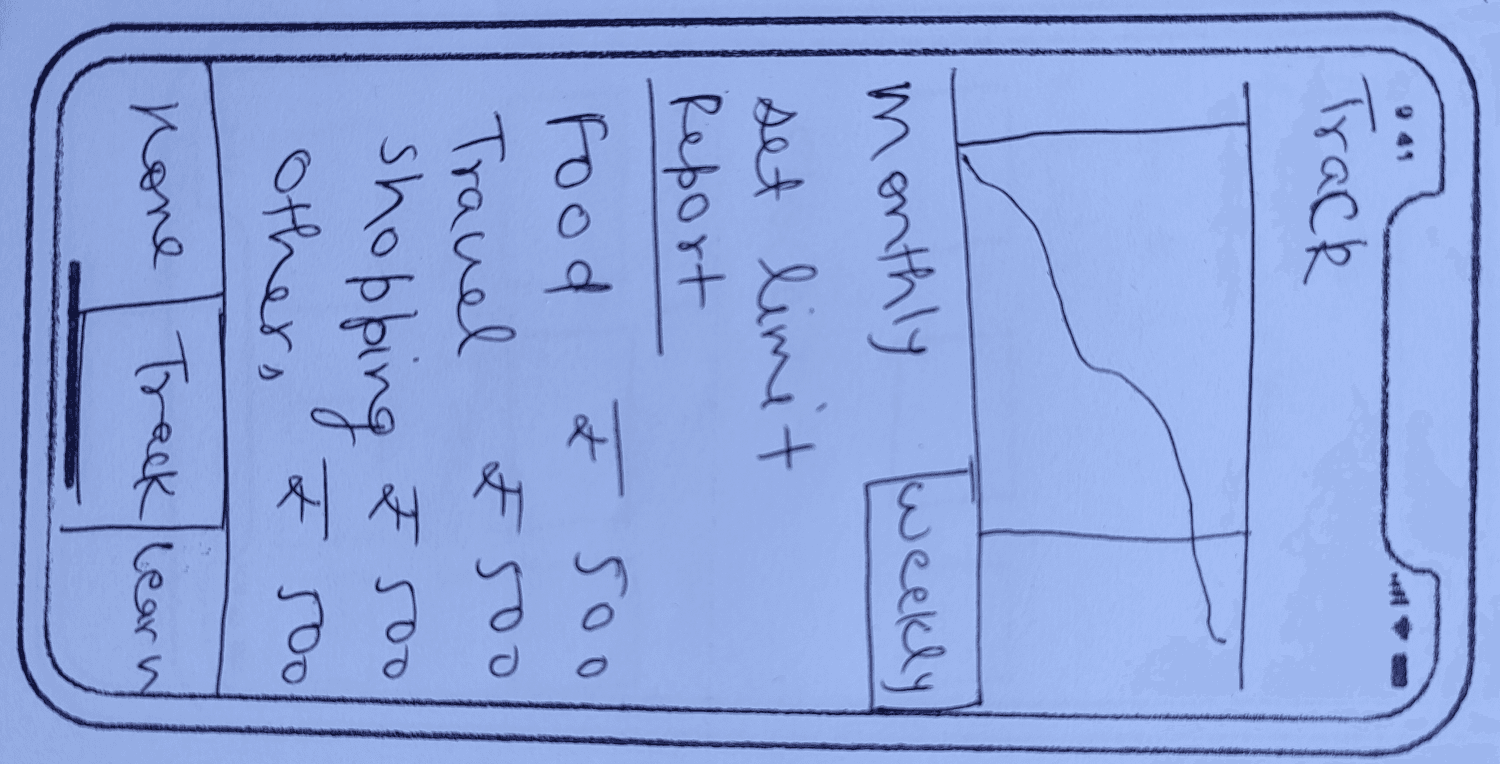

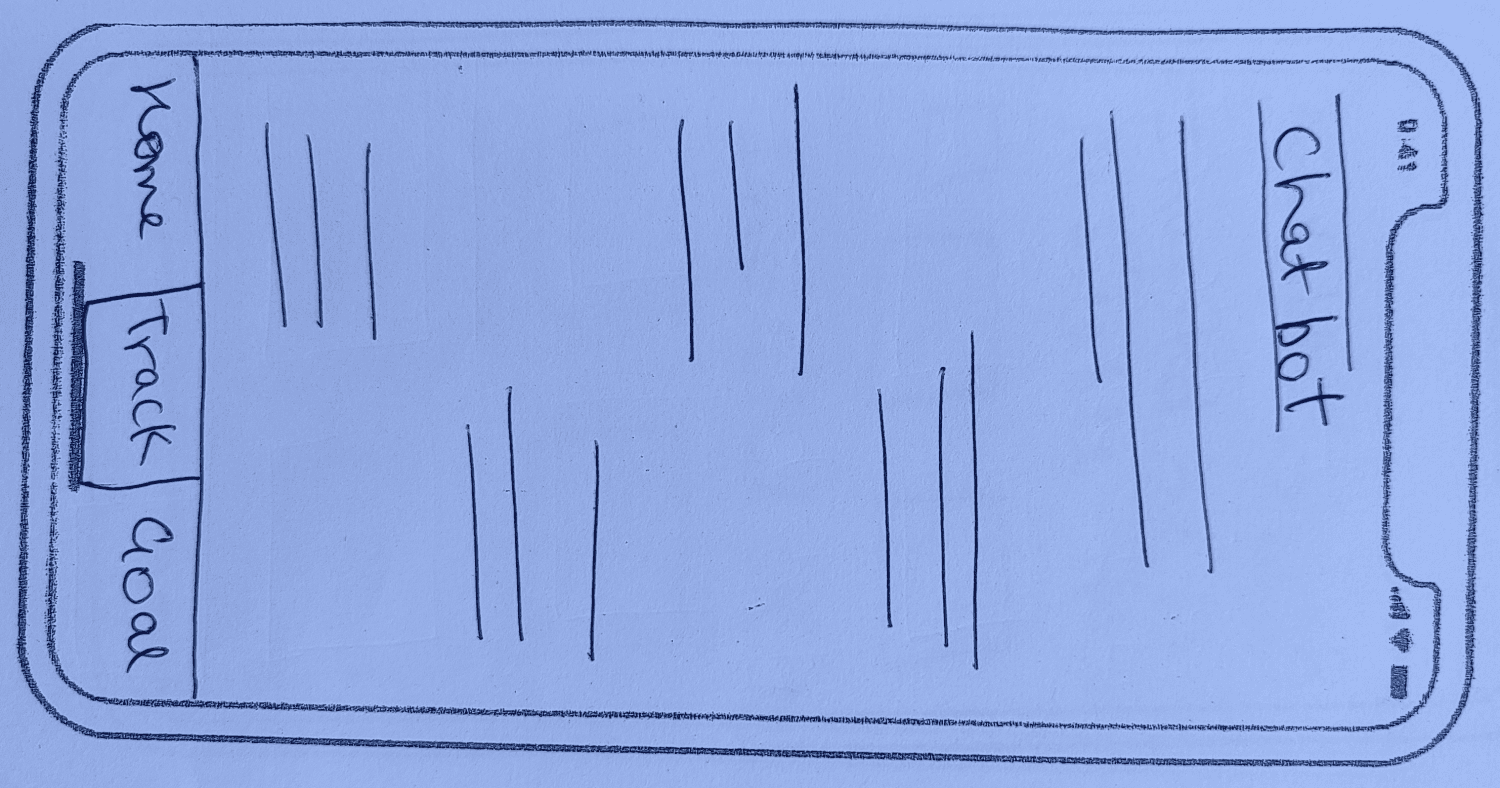

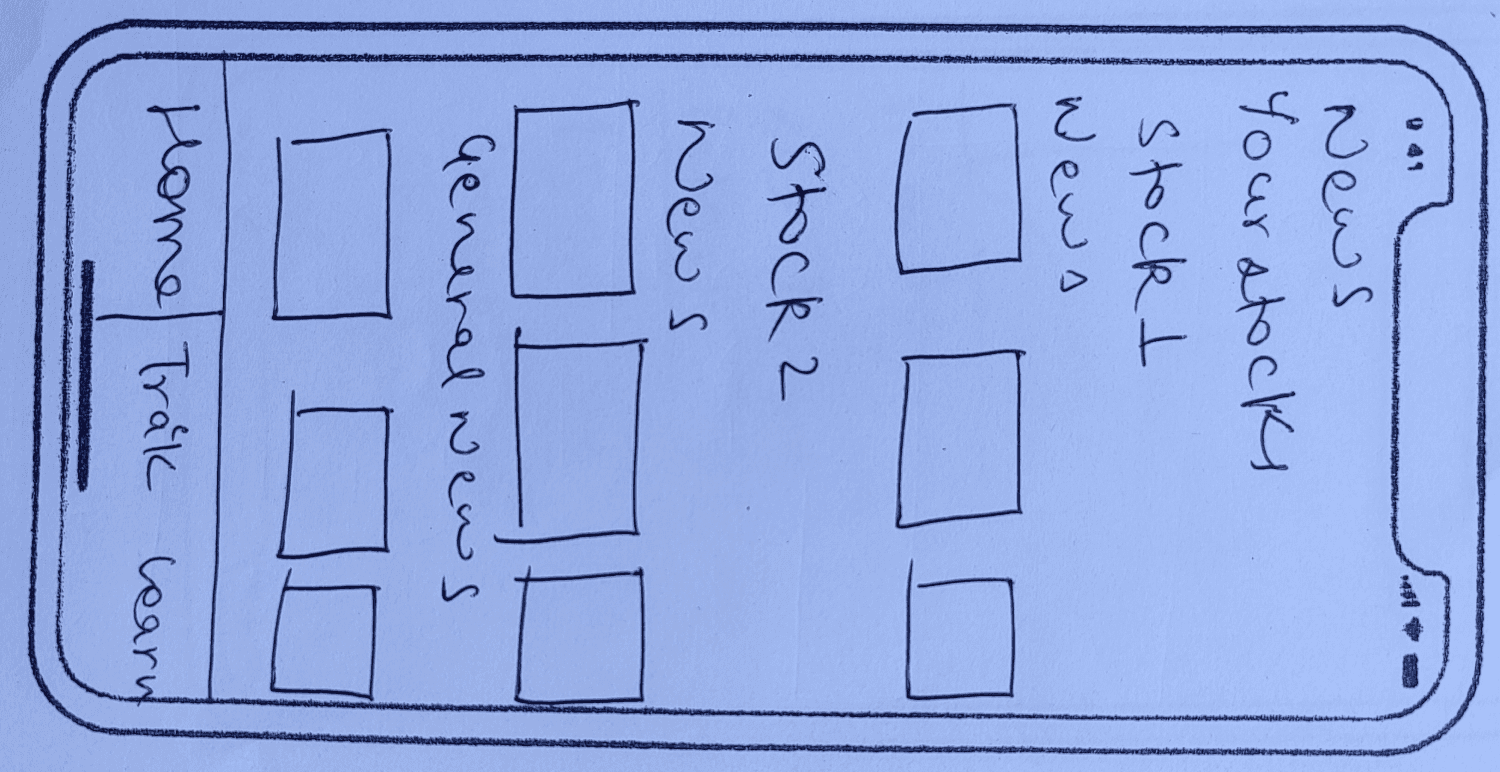

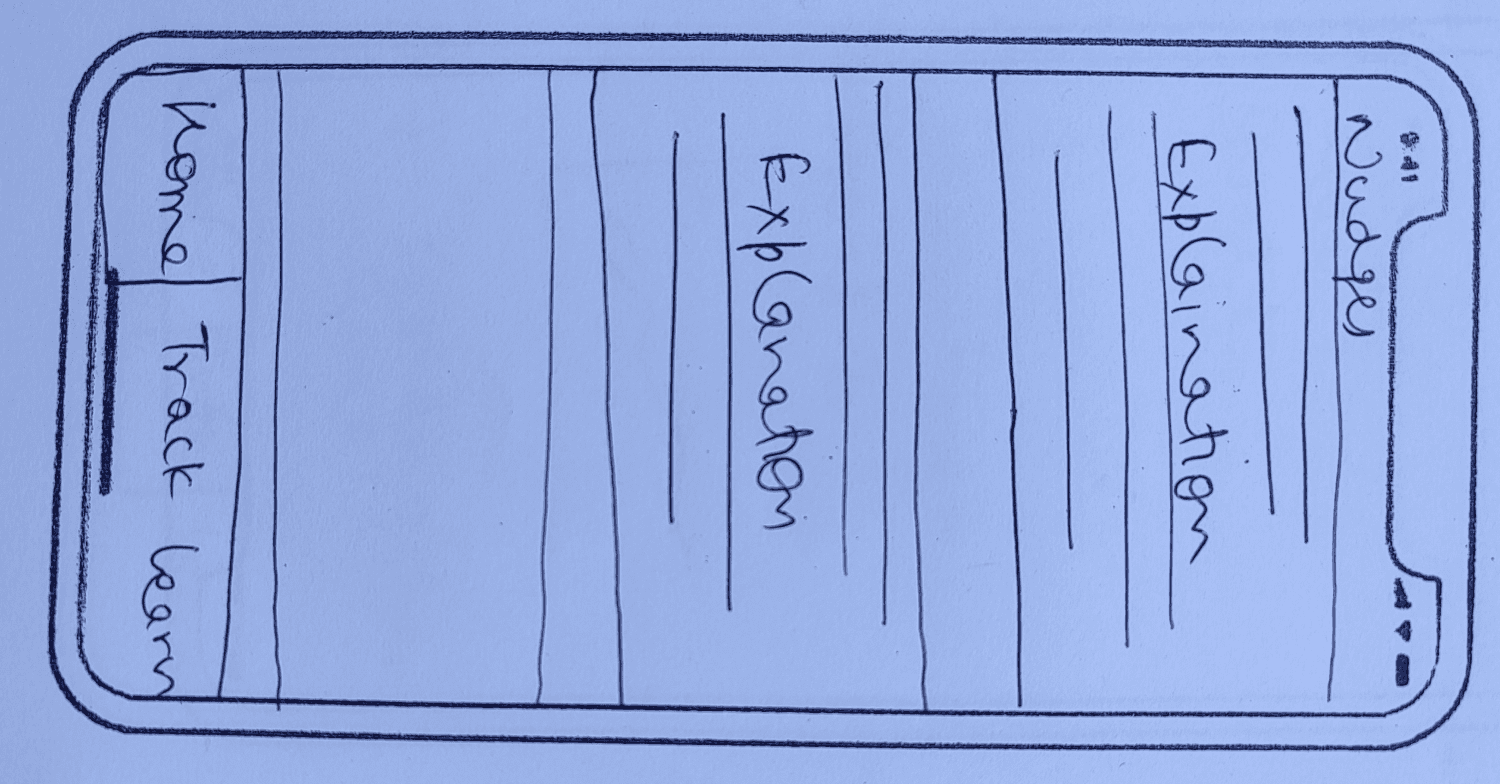

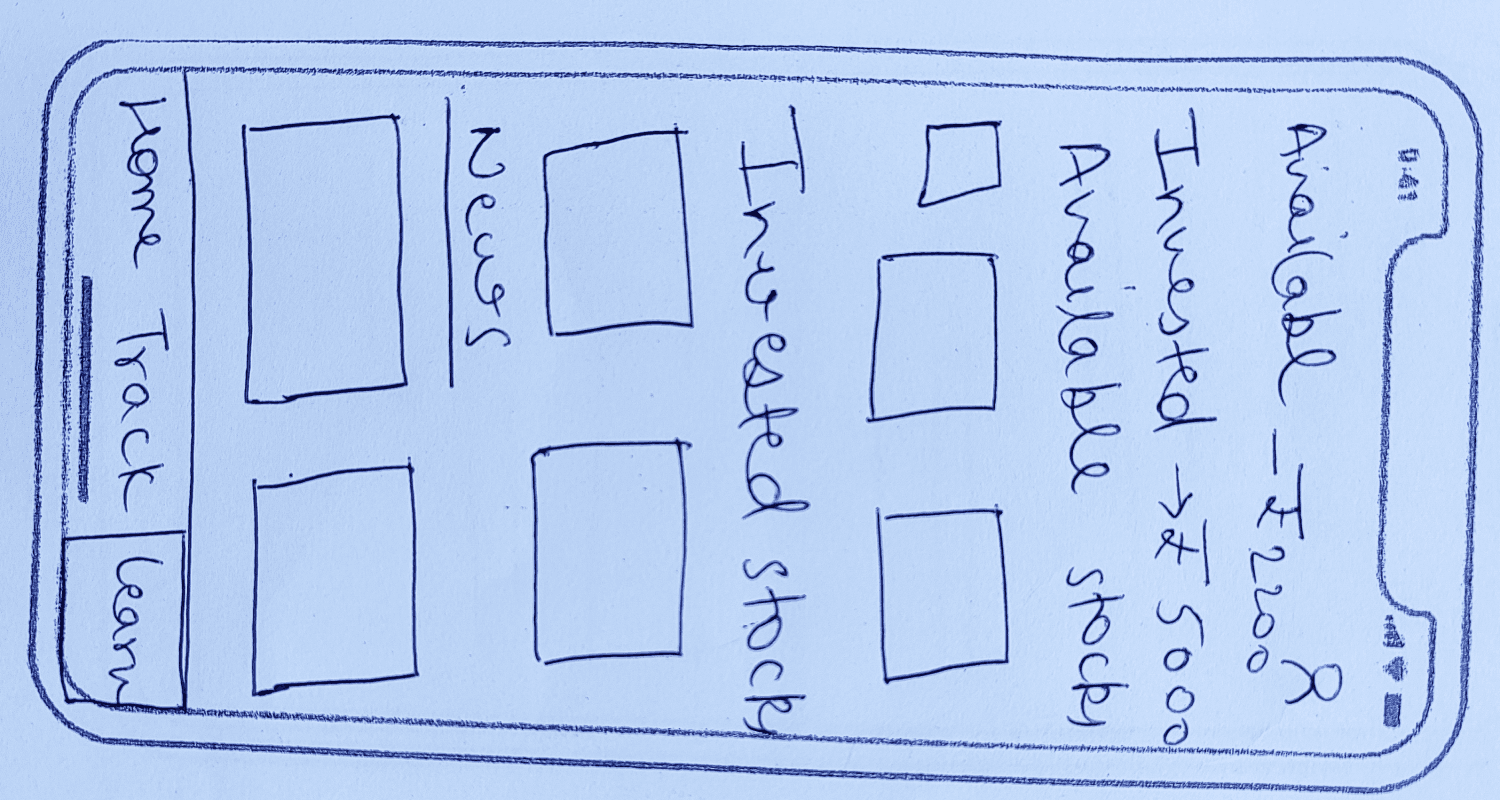

Initial Concepts

Sketching of concept

From Brainstorming some initial concets

Userflow

Open App

Home Screen

Learn

Track

Goal

Set a finacial

goal

Graph

Looks for graph to

track get along

Nudges

Check facts on

nudges

Limit himself

from spending

Spending

Look for spending in different

catagories of previous month

Add fack

money

Browse stocks

Learn different

factorsof stocks

Track spending

Buy

Set goal for

next month

Graph

Information Architecture

Splash screen

Old user

Home

Goal

Nudges

Bank Acc.

Demat Acc.

Sign Up

Track

Spending

Stocks

View chart

Buy

Sell

Categories

IPO

Learn

Design Guidelines

Modern blue gradient

Modern blue gradient

Red

Red

White

White

Green

COLORS

TYPE

LOGO

This logo contain the logo of rupee and “T” represent Finance and Track respectivaly

TrackP

#1E87FA

#1E87FA

#FF0000

#DF504E

#FFFFFF

#FFFFFF

#00CD22

PRIMARY

TEXT ON WITHE BG

FONT

Montserrat

Bold

Semibold

Regular

Medium

Light

DISAGREE

ALERT

BACKGROUND

TEXT ON BLUE BG

AGREE

#1C73D1

#1C73D1

Aa

Aa

24

Dec

16:30

HPCL

Target-Rs 120, Crt-Rs 115, SL-Rs 110

Facts

24

Dec

16:30

Tata motors

Target-Rs 120, Crt-Rs 115, SL-Rs 110

Facts

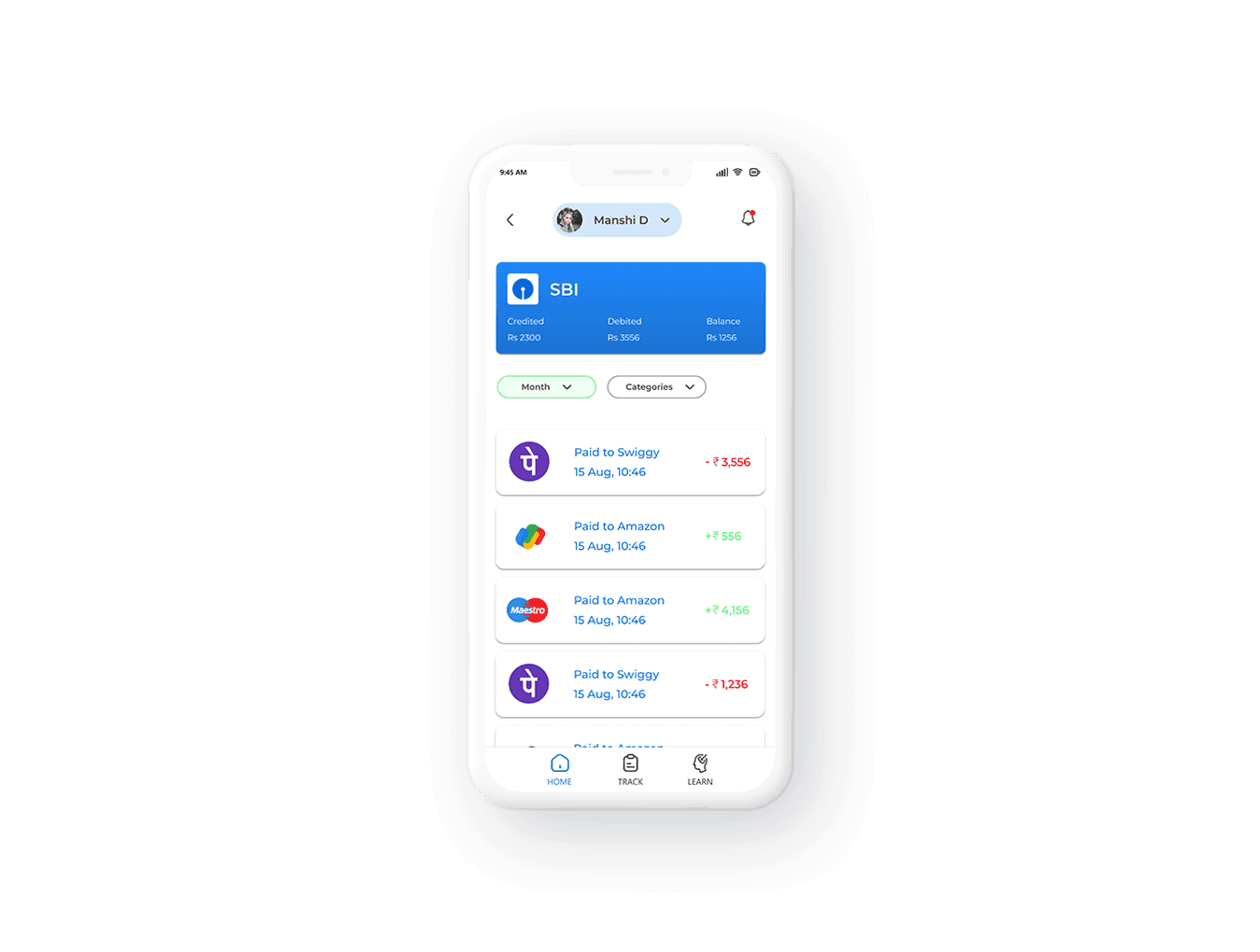

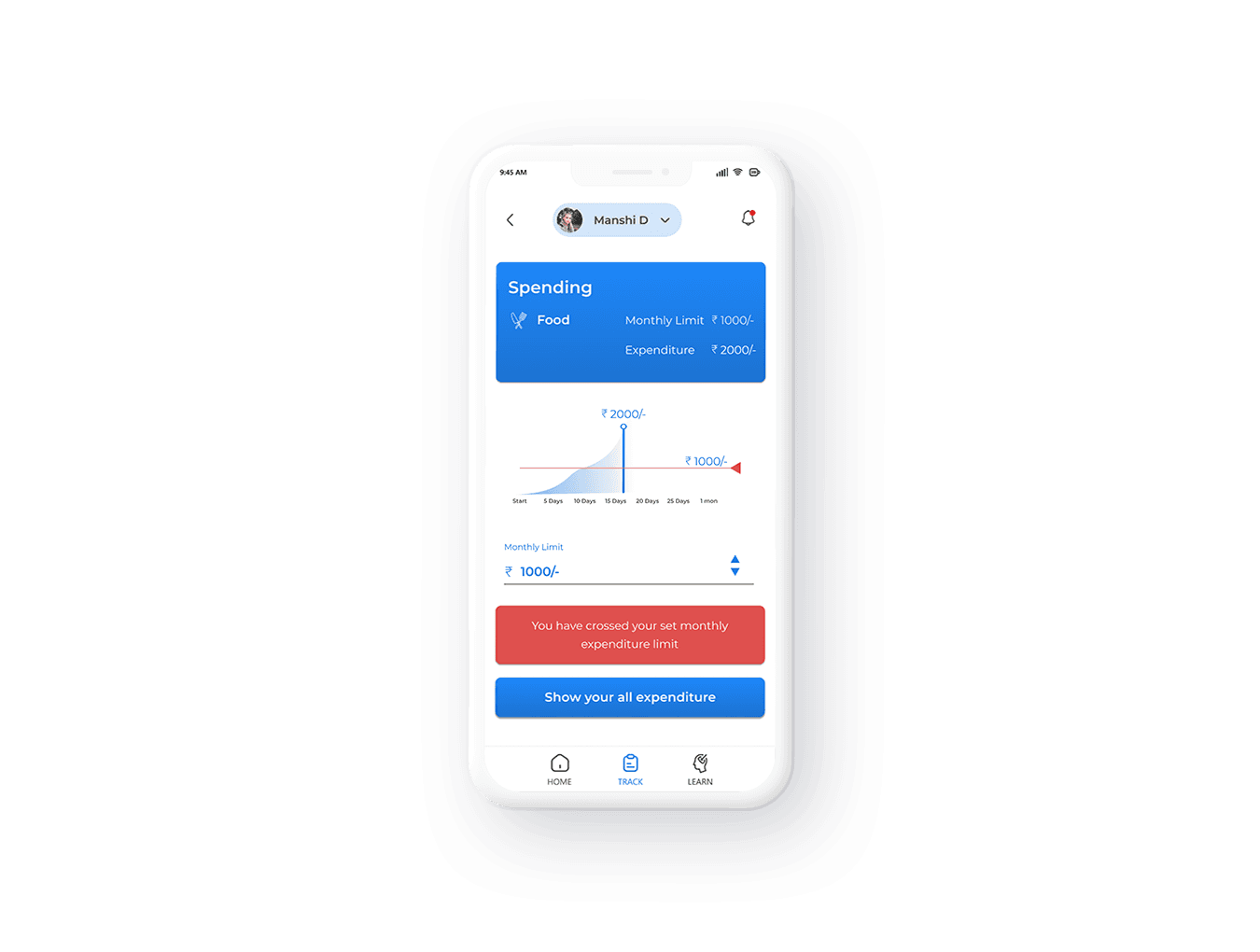

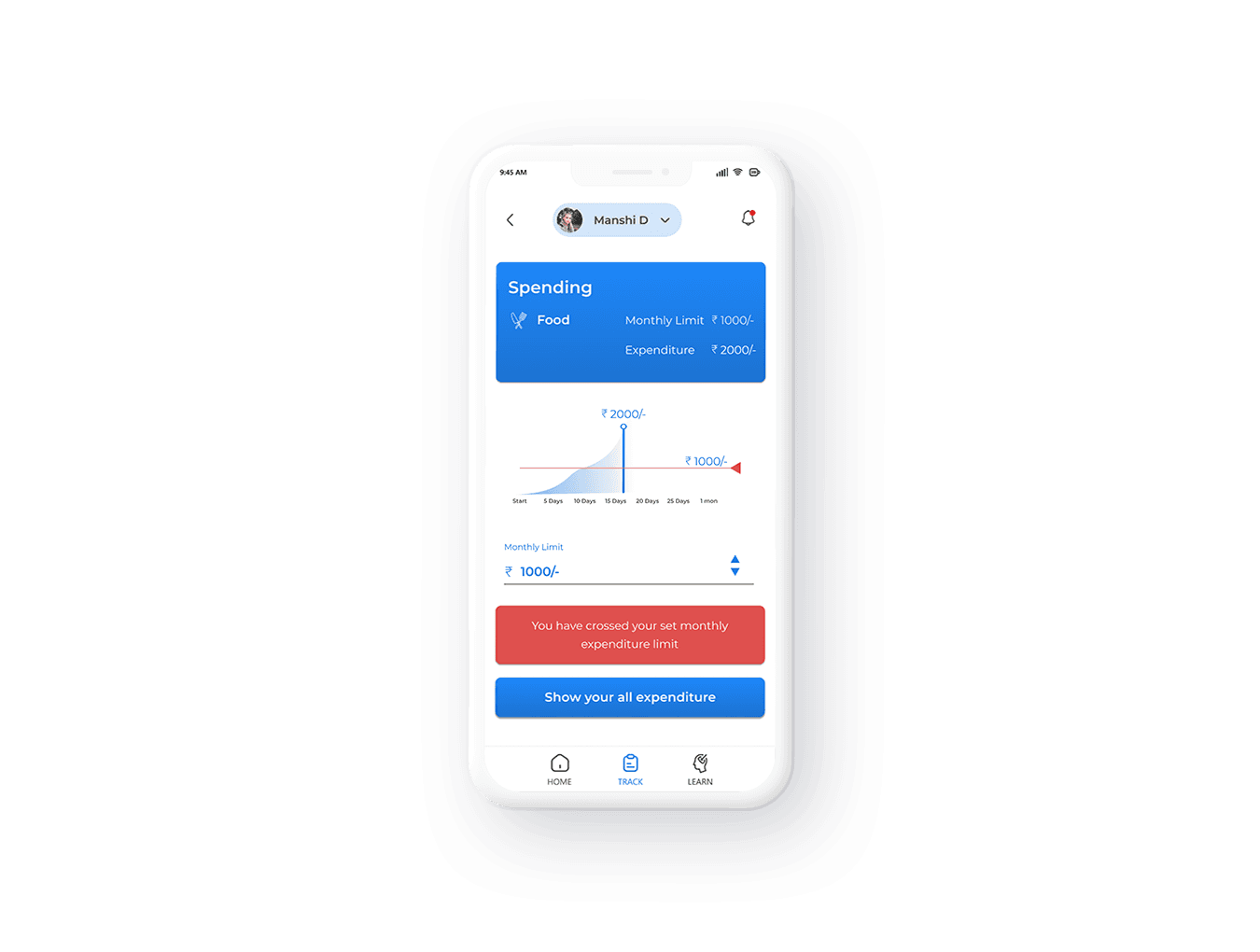

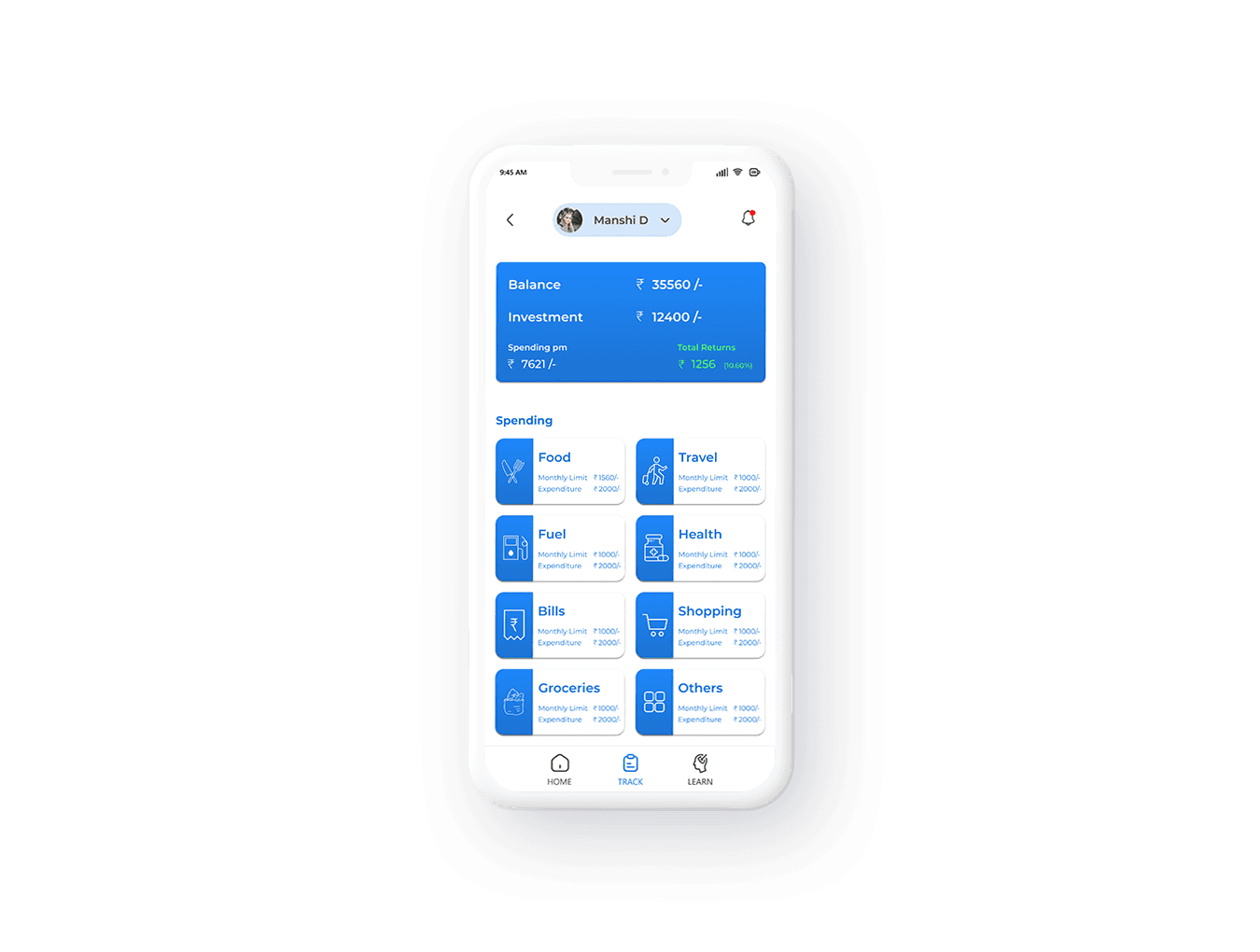

Spending

Food

Monthly Limit

1000/-

2000/-

Expenditure

Paid to Swiggy

15 Aug, 10:46

3,556

-

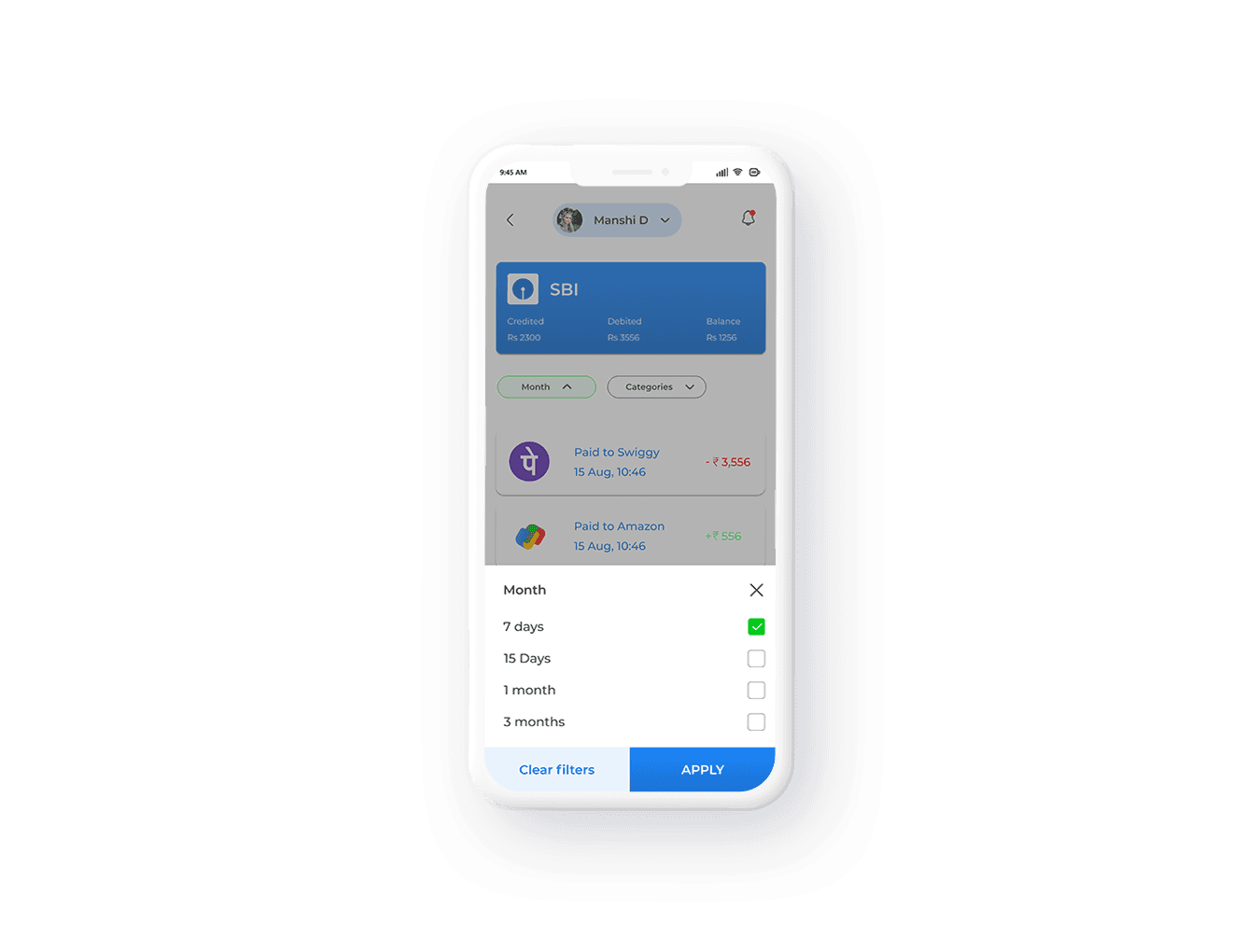

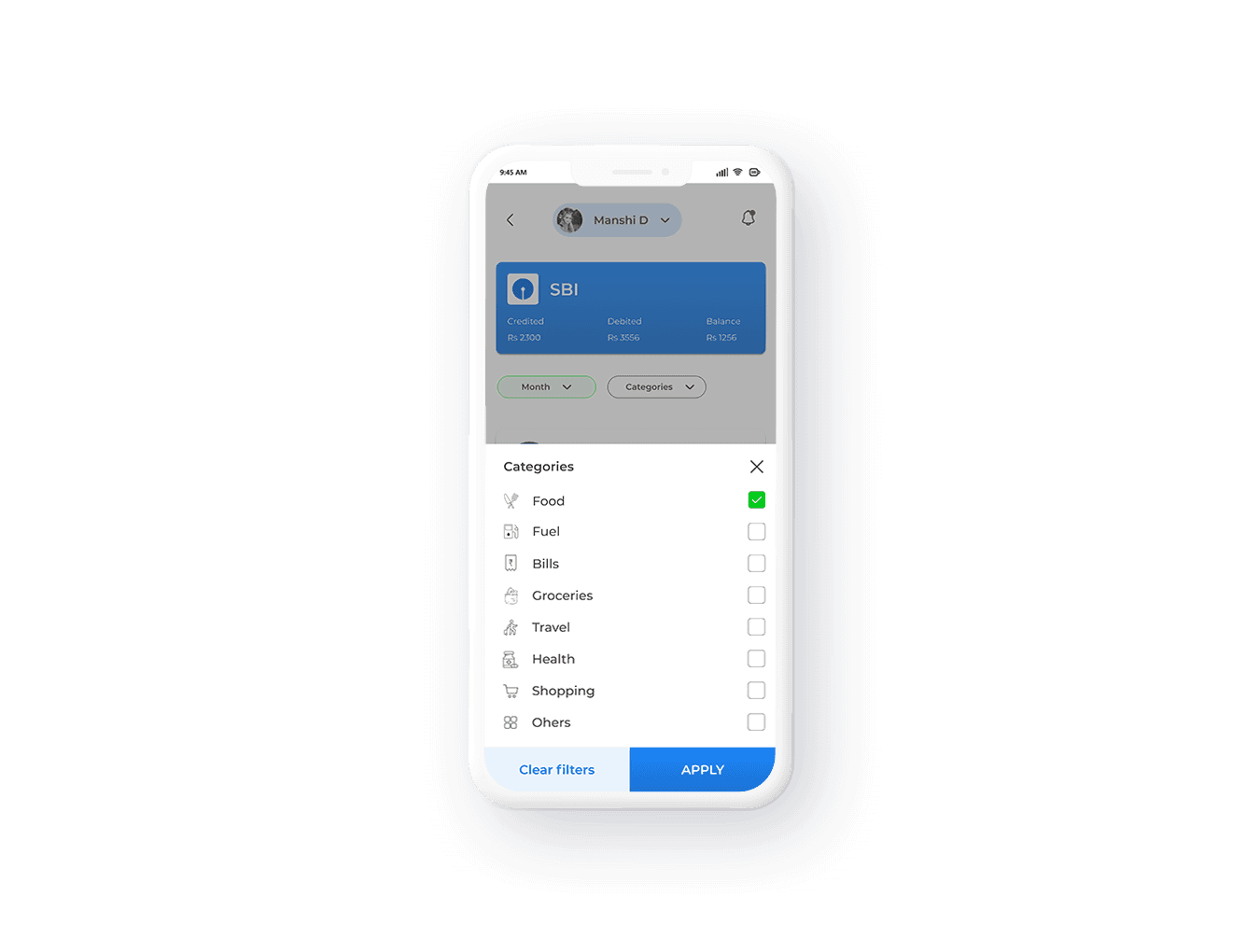

UI Eements

Categories

Categories

7 days

Month

15 Days

1 month

3 months

APPLY

Clear filters

Categories

APPLY

Clear filters

Food

Fuel

Travel

Ohers

Groceries

Bills

Shopping

Health

Continue

HOME

TRACK

LEARN

50,000

1,00,000

26,000

1,20,000

1

2

3

4

1 year

1.5 years

2 years

3.5 years

4 years

4.5 years

3 years

Start

journey

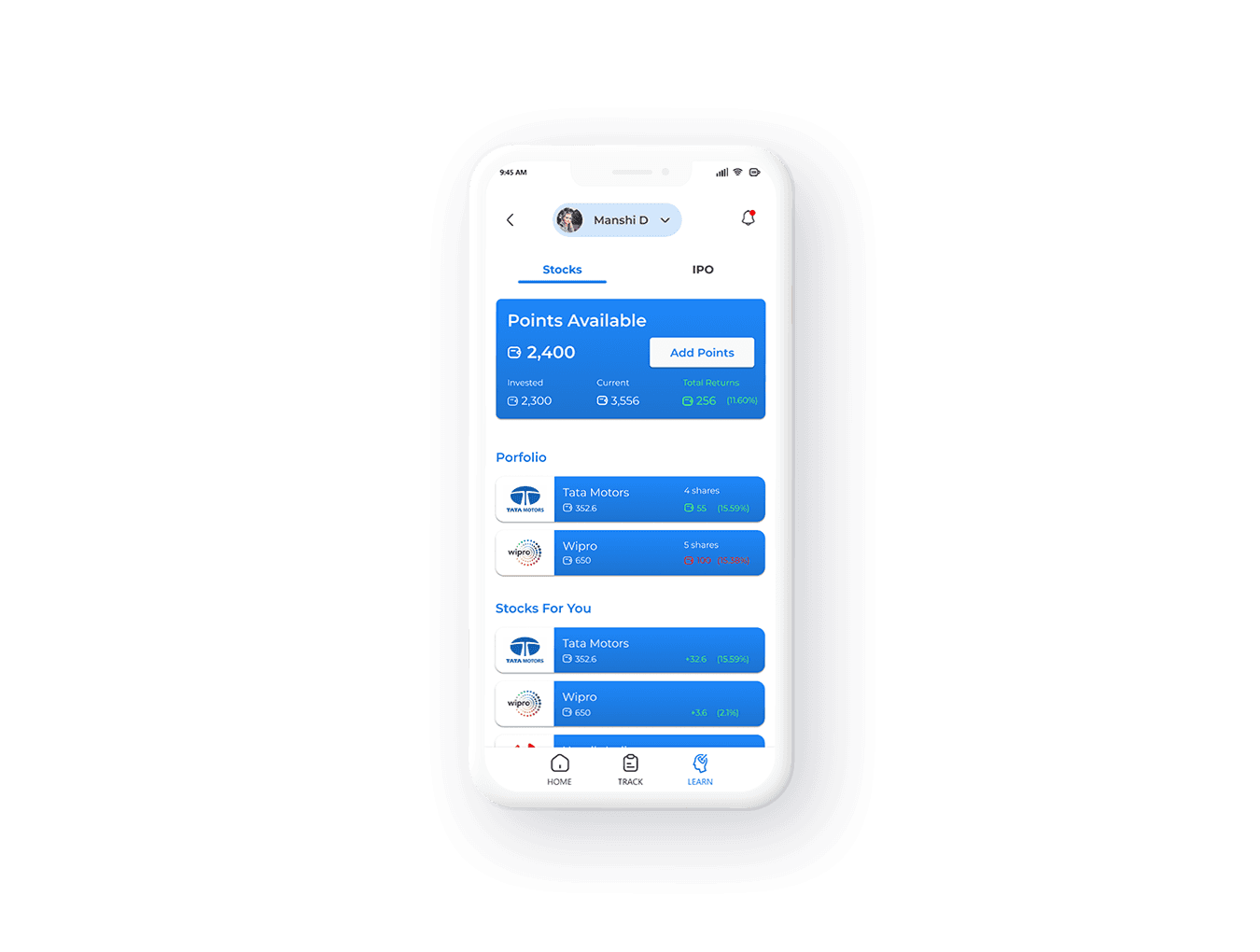

Porfolio

Tata Motors

4 shares

352.6

55

(15.59%)

Manshi D

BUY

SELL

2 mon

8 mon

4 mon

10 mon

6 mon

12 mon

13 mon

Start

journey

10,000

Mobile

Bike

1

2

Mobile number

You have crossed your set monthly

expenditure limit

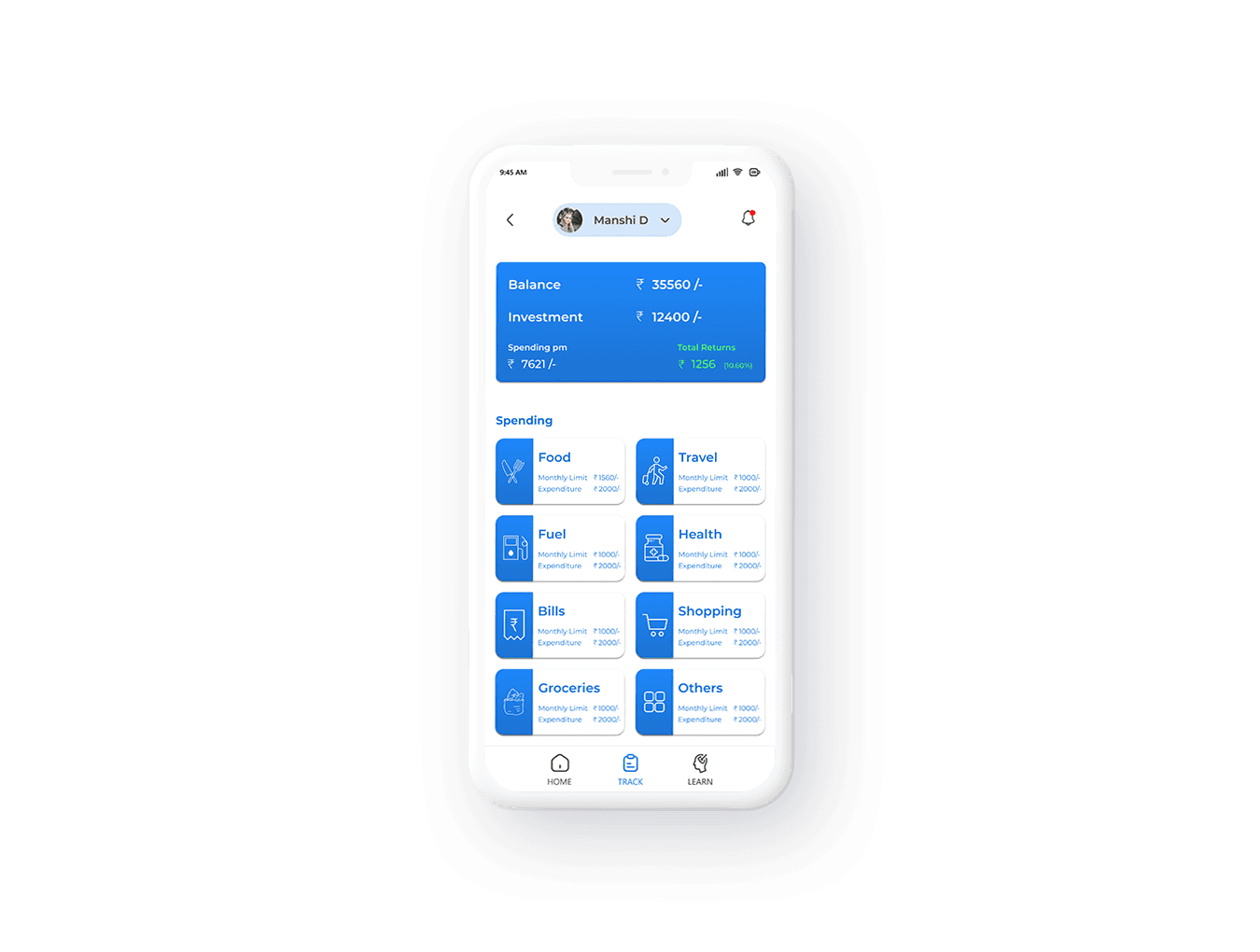

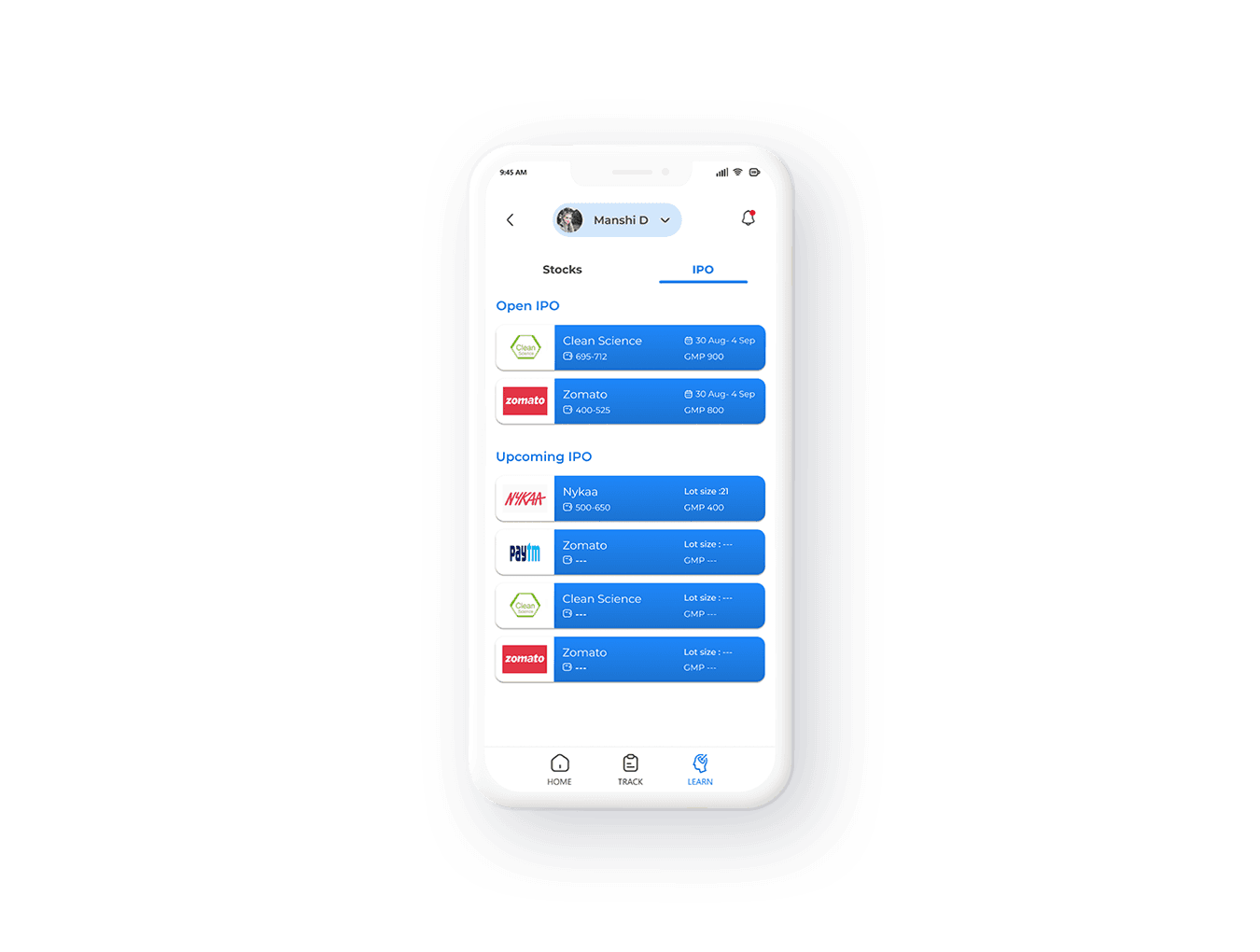

High fidelity

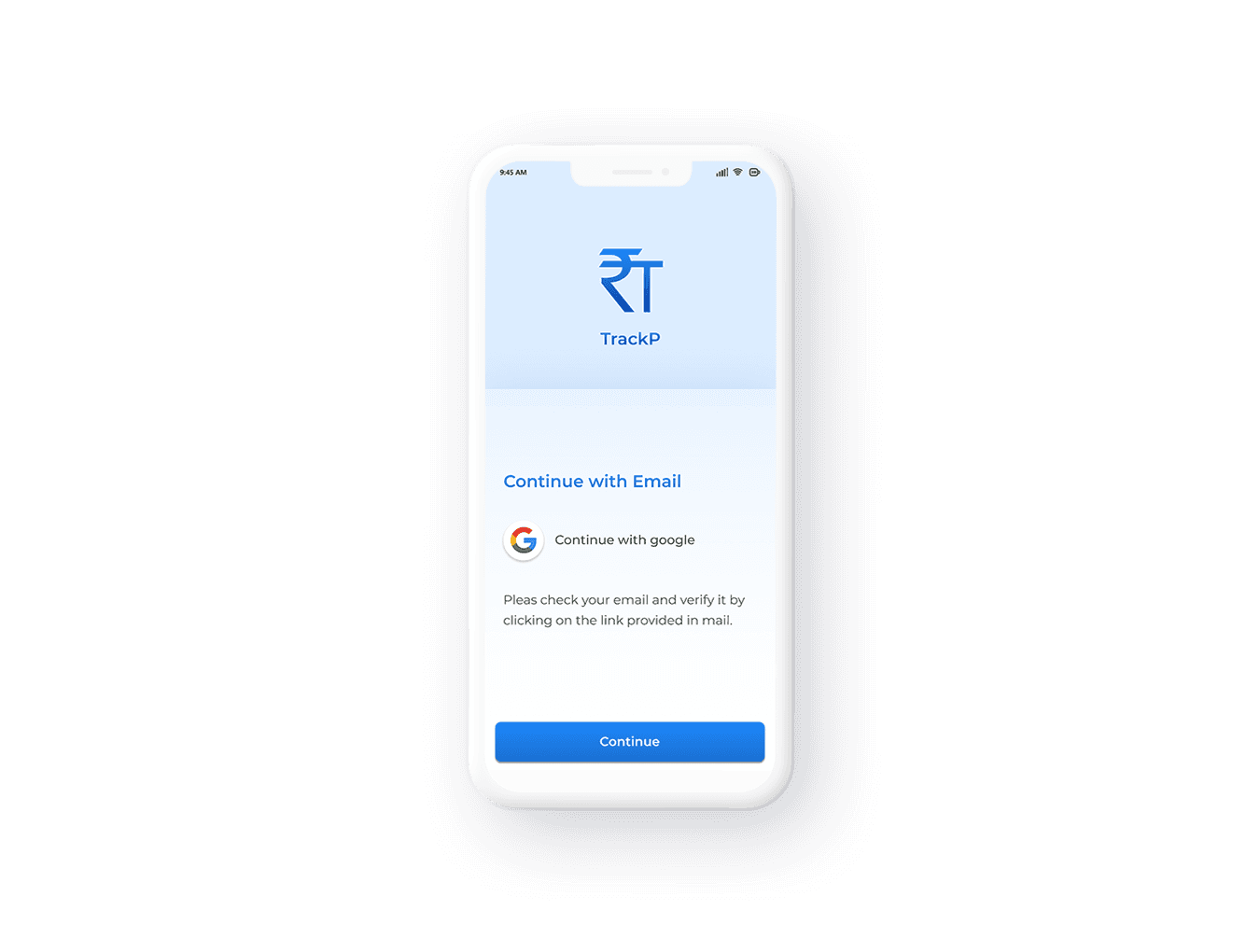

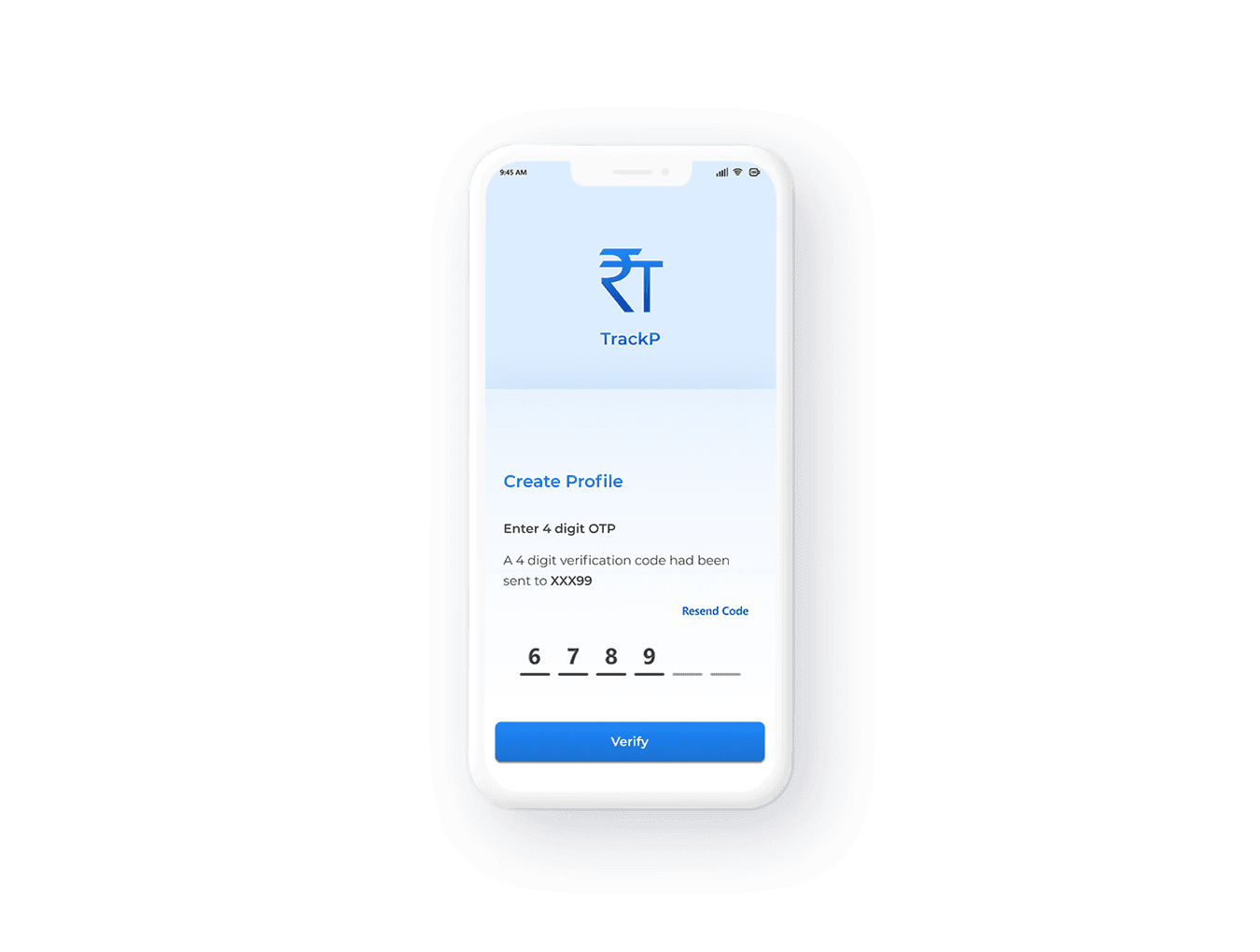

Onboarding screen to give an quick idea about the product.

Quick and easy Signup process

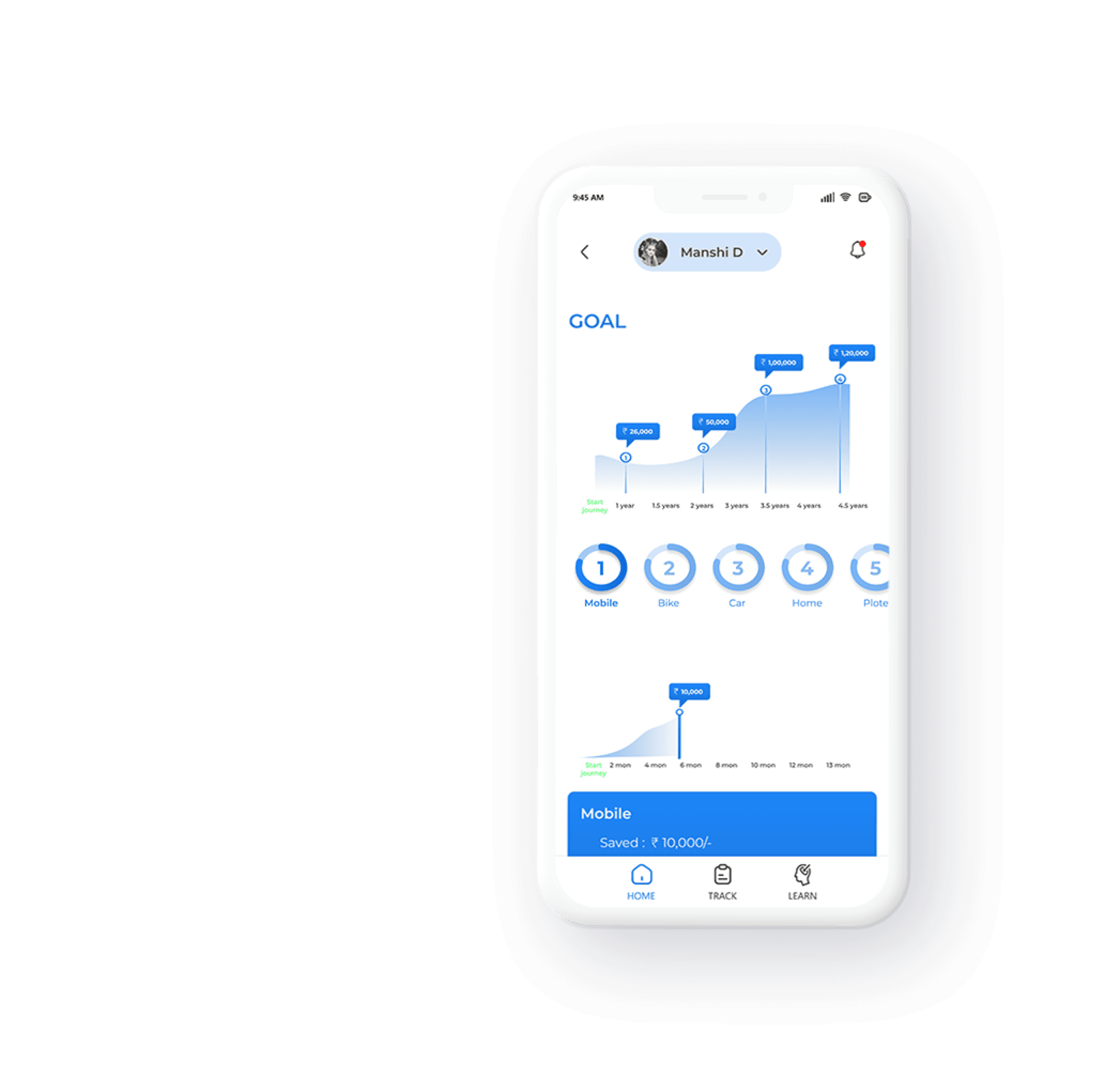

Track all your goals from single screen and define your own path

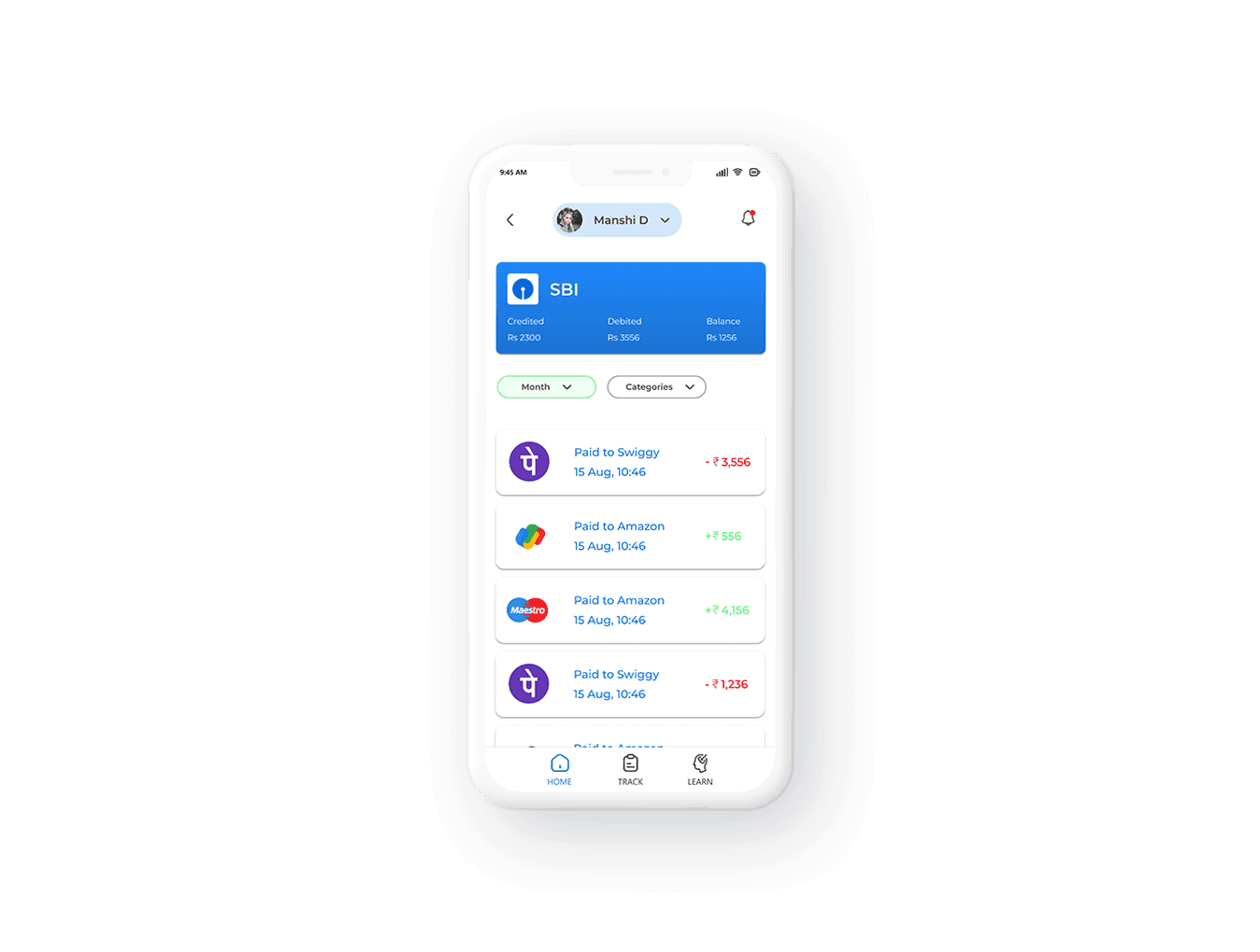

Giving user freedom to track expenditure in whatever way they want

Giving user control to divide expense in different categories and also set category limit

Learning investing by doing to go beyond fear of loss

Explore Other Work

Product Design

In this project, I have designed the web app for a client that streamlines the Competency Assessment experience.

View Case

UI Design

UX Research

Product Design

Interaction Design

In this project, I have designed the mobile app for a client that streamlines the IT ticket-raising experience.

View Case

UI Design

UX Research

UX Research

My responsibilities were to improve the usability(Effectiveness, Satisfaction & Efficiency) of the canvas by keeping in mind the constraints of the design system and bringing the consistency throughout the canvas of the eQ technologic products.

View Case

UI Design

Heuristic Evaluation

Prototyping

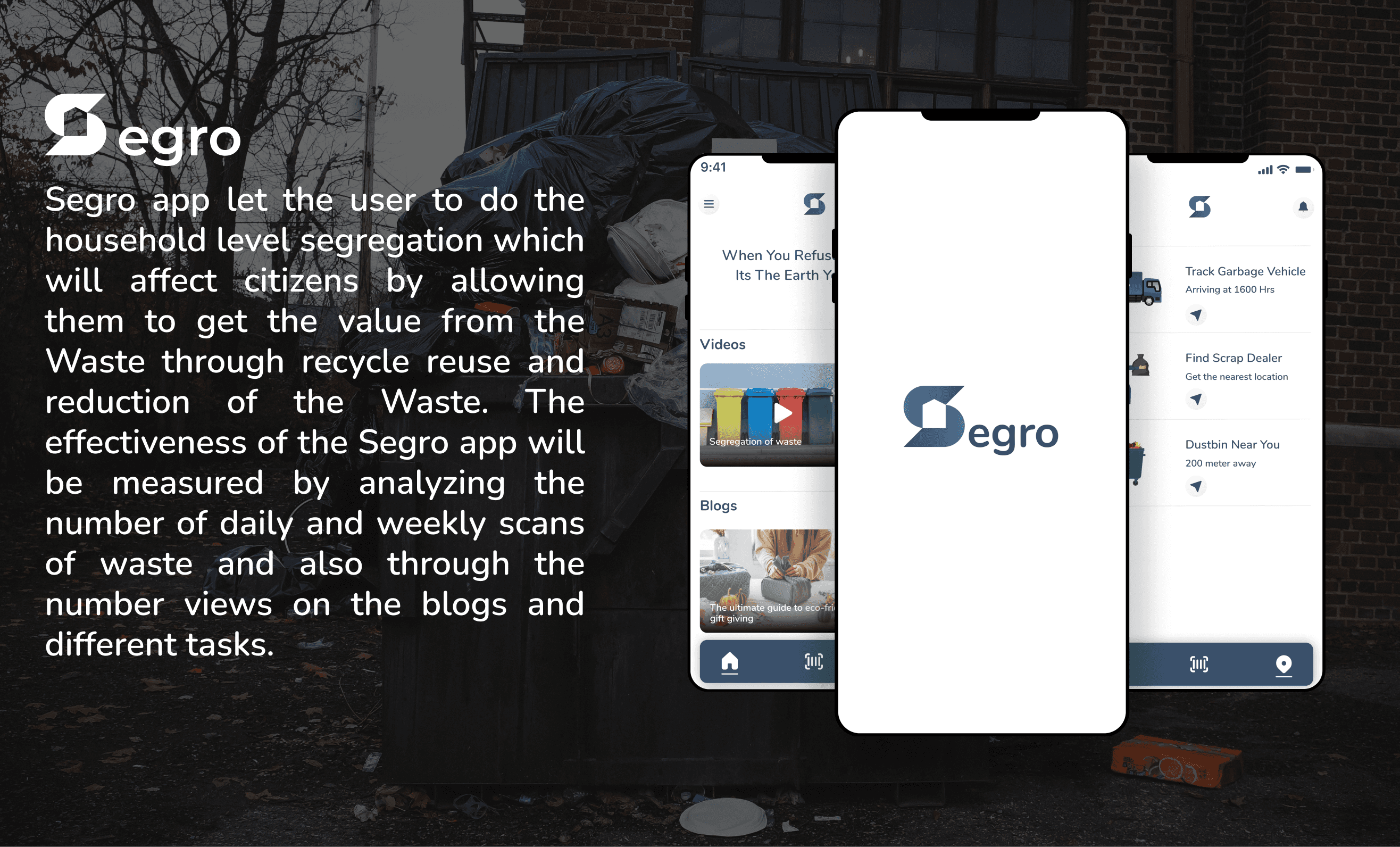

UX Research

In this project I tried to integrate the technology with a properly designed system of household level segregation so that waste does not just end up in landfills but is processed and reused.

View Case

UI Design

Prototyping

Usability Testing

Let's Talk